Dennis Muilenburg believes this is one of the best possible times to be an aerospace and defence company.

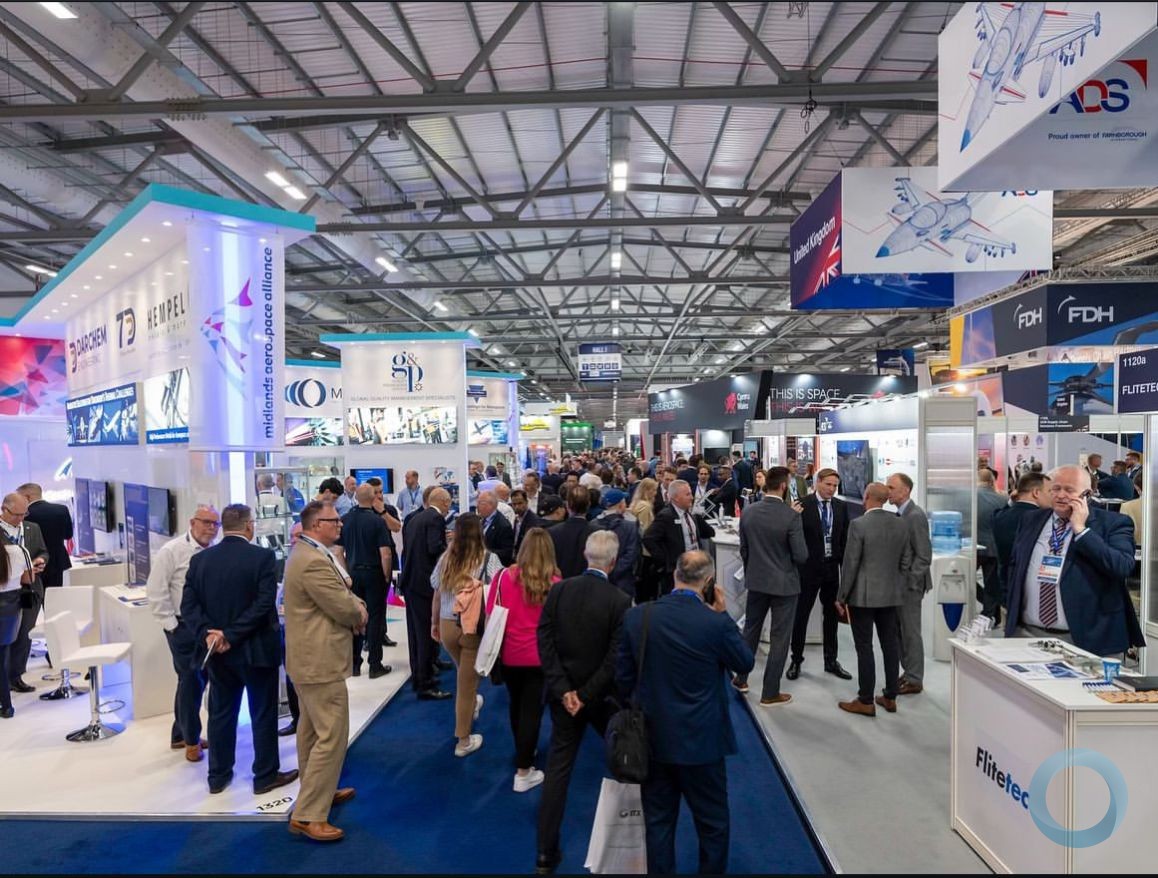

Markets may fret about how a Trump-triggered trade war could hurt Boeing, the iconic US aircraft manufacturer that he took over as chief executive in July 2015. But as he surveys the world from the vantage point of the UK’s biennial Farnborough air show, Mr Muilenburg is pleased with almost everything he sees.

Industry experts, stock market analysts and company insiders all agree on one thing: Mr Muilenburg has brought a new aggressive style of confidence to Boeing. But there are differing opinions on whether, and to what degree, that is a good thing.

“Dennis is too gung-ho. Nothing is ever bad,” said one veteran aerospace analyst, referring to Mr Muilenburg’s repeated claim that the boom and bust cycle that has dogged the aerospace business for decades is over. “A bit of humility and conservatism would go a long way”.

Nevertheless, Cai von Rumohr, aerospace analyst from Cowen investment bank, believes concerns about the potential impact of a downturn in the commercial aircraft sector are overblown. “What is not appreciated is the resilience of the demand upswing and Boeing’s favourable productivity,” he said, along with better cash generation from the rise of higher margin services and defence sales in the company’s mix.

In an interview with the Financial Times on the eve of the Farnborough show, and then during it, the 54-year-old Mr Muilenburg stuck firmly to an upbeat message. He declared the end of cyclical performance, insisting that profits would be more stable thanks to “fundamental shifts over the last decade”. These include a more global spread of orders, huge backlogs representing eight years of production and the growing importance of new high-margin services made possible by the digital revolution.

Boeing has come a long way since Mr Muilenburg took over three years ago. Back then, delays to the 787 Dreamliner were causing a financial hangover, while the company faced an investigation into accounting practices on the programme. Airbus, its European arch rival, seemed to have the upper hand, while Boeing was on the defensive.

Slowly, the tables were turned: Airbus faced several European anti-bribery investigations, and tensions flared at the top. As Airbus’s Franco-German management slugged it out, Mr Muilenburg brought in fresh blood — including former General Electric executive Kevin McAllister, now head of Boeing Commercial Airplanes. Customers say Mr McAllister is reinvigorating the business.

In a move that one company insider says did much to build trust with middle management, Mr Muilenburg vowed to make personal contact with 17,000 Boeing managers within his first year. He went on to do so, listening carefully to what they had to say.

He also surprised the industry by halting his predecessor’s long-running battle with unions at its Seattle plant — though he later fought unionisation of the company’s South Carolina plant. And tough union negotiations may lie ahead if Boeing decides to go ahead with a new “middle of the market” aircraft given that Mr Muilenburg has stressed that affordability will be key.

Mr Muilenburg expressed confidence that Boeing is on its way to finalising a deal with Embraer, the Brazilian aircraft maker, at the smaller end of the commercial aircraft market.

But he rejected suggestions that he may have erred in challenging Embraer’s Canadian rival, Bombardier, with a US trade complaint over government subsidies. That not only irritated Boeing’s Canadian and UK defence customers, but may have handed Airbus an early advantage in smaller passenger jets. Bombardier’s C Series, the industry’s newest clean sheet aircraft, was virtually given away to Airbus as a result.

“We would not change our approach there,” Mr Muilenburg told the FT. “We have to take the long-term view here and it’s important for us always to stand on the principle of free and open trade and fair trade . . . That was the principle behind the Bombardier matter.”

But even if Boeing avoids becoming collateral damage in a trade war, industry watchers say the company is now in a period of significant upheaval — and some say Mr Muilenburg’s confidence could have unintended consequences.

“At Boeing, everything is fine — right up until the moment when it’s not,” said Scott Hamilton of Leeham, an aerospace consultancy and news website.

One industry insider said: “They are moving on a lot of different strategic fronts at once: Bombardier, Embraer, the supply chain, verticalising production, building a $50bn services business. That’s a lot for a company that operates slower than anybody else in a very, very slow industry.”

Rob Stallard, aerospace analyst at Vertical Research, also expressed concerns about Mr Muilenburg’s aggressive new services business, a diversification that will reduce cyclicality but could also threaten the stability of the suppliers that Boeing relies on.

“Boeing is invading the supply chain,” Mr Stallard said. “This is potentially a seismic structural change. Before suppliers would get abused on price, but at least they got the aftermarket.”

Mr Muilenburg acknowledged the existence of tariff-shaped clouds on the horizon. Concerns are growing that the trade dispute between China and the US, and a separate US offensive against aluminium and steel imports from the EU, Mexico and Canada, will hit global growth.

But he denied that tariffs have so far had any material impact on his company and the shares are more than 2.5 times higher than when he took over.

Mr Muilenburg also brushed aside concerns that Boeing might be weakening its supply base by squeezing ever more price cuts from suppliers, even as it encroaches further on their profits with its plans to bring more manufacturing in-house and to build a $50bn services business.

Soon after Donald Trump’s election in 2016, Boeing found itself at the rough end of several presidential tweets about the cost of two replacement Air Force One aircraft. But Mr Muilenburg quickly found a way to manage relations with the irascible president. Last year Mr Trump appeared at the planemaker’s factory in South Carolina and declared “God Bless Boeing”, and earlier this week Boeing allowed the White House to declare victory in the Air Force One price battle, permitting Mr Trump to claim that he saved US taxpayers $1.4bn on the deal.

Mr Trump’s support is notoriously fickle: he shifted from declaring his love of Harley-Davidson motorcycles to threatening the company last month after it said tariffs would force it to move more production overseas. Mr Trump’s blessings for Boeing could turn to curses just as quickly, and if those tariff clouds on the horizon turn dark and threatening, global airline traffic will surely suffer.

Mr Muilenburg may need all the confidence he can muster, just to get him through the next few months. Luckily for Boeing, it is not in short supply.